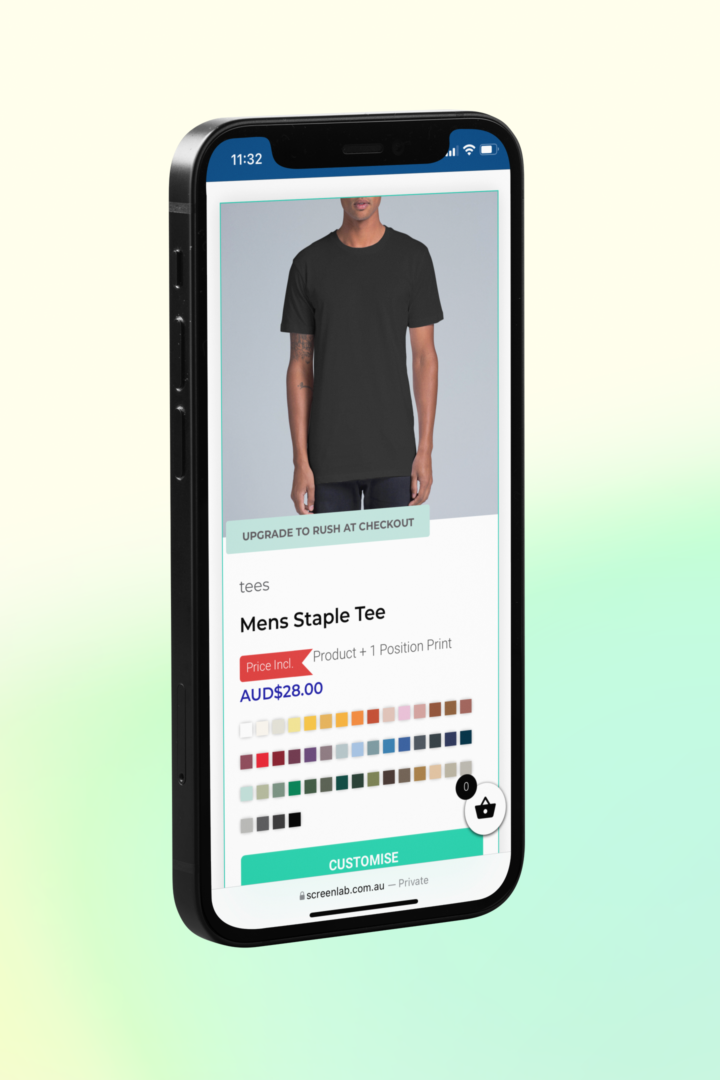

Hey, Australia 👋

Get Your Custom T-Shirts & Apparel Printed Fast with No Minimums at Screenlab

High-Quality, Fast, and Hassle-Free Custom T-shirts, Hoodies, Caps & more for Small Business Owners and Custom T-Shirt Enthusiasts.